By Rose Quint

What Home Buyers Really Want, 2021 Edition sheds light on the housing preferences of the typical home buyer, but also on how those preferences change over time, and how they may vary based on demographic factors such as age, income, and geography. Read on for three takeaways from the survey:

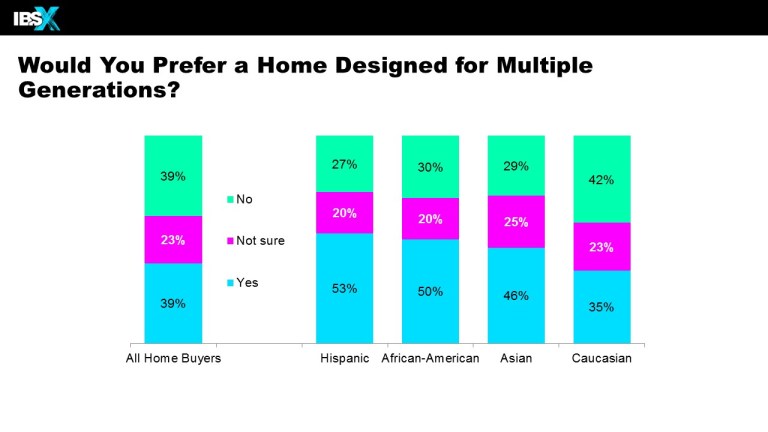

1. Buyers Are Split on Multigenerational Homes

A multigenerational home is desirable to some buyers, but not to all. According to the survey, buyers are evenly divided when it comes to the desire for a home designed to house the buyer as well as a younger generation and an older generation: 39 percent would prefer such a home, but 39 percent would be against it. The remaining 23 percent are not sure how they feel about a home designed for three generations.

One of the factors most likely to influence a buyer’s preference for a multigenerational home is race/ethnicity. Among Hispanic buyers, for example, 53 percent are in favor of buying such a home, compared to 27 percent who would oppose it. Among African-American and Asian buyers, 50 percent and 46 percent, respectively, would prefer a multigenerational home, significantly higher shares than the 30 percent and 29 percent who would be against the idea, respectively.

In contrast, among Caucasian buyers, only 35 percent of buyers would prefer a home designed for multiple generations, compared to a larger 42 percent who would not prefer that option.

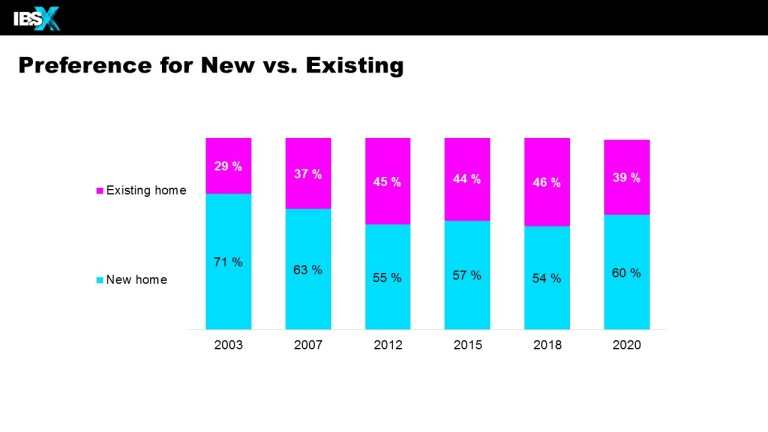

2. Home Buyers’ Preferences Shift Towards New Construction

According to the survey, 60 percent of home buyers would prefer a newly-built home over an existing home. In other words, all else equal, their first preference would be to purchase a new home. New homes in this post refer to both homes built for-sale (including the land) as well as homes custom-built on the buyer’s land.

Looking at historical data shows a clear shift in preferences towards new construction in 2020. The share of buyers who would have preferred to buy a new home last year (60 percent) was six points higher than in 2018 (54 percent) and the highest in this series since 2007 (63 percent).

Some of the most important factors contributing to the rising desirability of new homes in 2020 include:

- New homes have the features buyers want today;

- Buyers are concerned about touring occupied existing homes during the COVID-19 era; and

- New homes are more likely to be located where a growing segment of buyers wants to live: the outlying suburbs.

Across generations, Gen X buyers are the most likely to prefer a newly-built home (68 percent), ahead of both Millennials (65 percent) and Baby Boomers (55 percent).

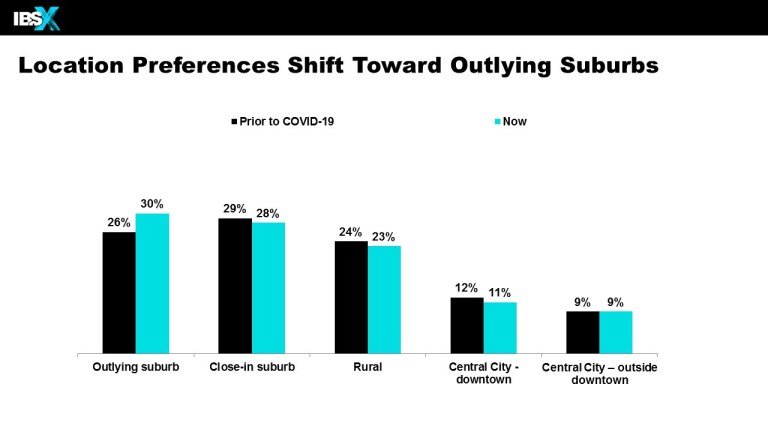

3. Outlying Suburbs Appeal to More Home Buyers

COVID-19 has impacted the housing preferences of 25 percent of home buyers. More specifically, the survey asked about location preferences both prior to COVID-19 and now: did buyers’ preferred location change as a result of the pandemic? Results show that a segment of home buyers have in fact shifted their preference towards the outlying suburbs due to the health crisis.

Prior to COVID-19, 26 percent of buyers wanted to buy a home in an outlying suburb; since the beginning of the pandemic, that share is now 30 percent. On the other hand, each of the other location options saw small declines or no change at all in preference.

For example, the share of buyers who would prefer a close-in suburb went from 29 percent prior to COVID-19 to 28 percent now; for a rural area, the share went from 24 percent to 23 percent; and for the downtown area of a central city, from 12 percent to 11 percent. Meanwhile, the share of buyers who want to purchase their next home in the central city outside of downtown remained unchanged at 9 percent before and after the onset of COVID-19.

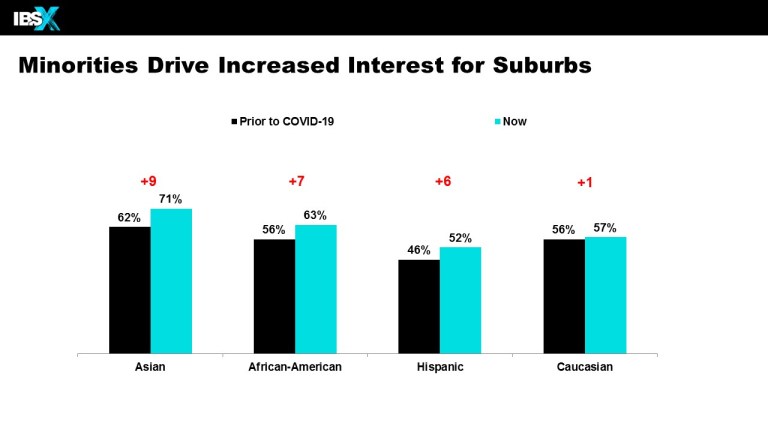

Looking at results across racial/ethnic groups reveals that minorities are driving the increased interest for the suburbs (whether outlying or close-in). Among Asian home buyers, 62 percent preferred a suburban location prior to COVID-19, compared to 71 percent now –a 9-point increase. Among African-American buyers, the share rose seven points, from 56 percent to 63 percent; and among Hispanic buyers, it increased six points, from 46 percent to 52 percent. Meanwhile, the share of Caucasian buyers who prefer a suburban location did not change much because of COVID-19, up only one point from 56 percent to 57 percent.

*What Home Buyers Really Want, 2021 Edition is based on a comprehensive, nationwide survey of 3,247 recent and prospective home buyers conducted in the summer of 2020. For a complete article summarizing the most important findings, please click here.

This post was originally published on NAHB’s Eye on Housing blog, where NAHB’s economists discuss the latest housing data and policy.