In March 2020, anxious efforts to curtail the spread of COVID-19 transformed communities into shutdown mode across the U.S. and the world. Health care providers focused on managing personal protective equipment and caring for the ill. As weeks turned into months of the coronavirus, pundits pondered, “What does this pandemic mean for the future?” Predictions abounded for small businesses, personal services, economic outlooks.

Yet, as people stocked up on toilet paper, downloaded an app called Zoom, and sheltered in place under their own roofs, marketing expert Teri Slavik-Tsuyuki wondered, “What will COVID mean for homes and communities?” And she started to craft a crystal ball to learn about Americans’ emerging ideas about home in the present and future.

Slavik-Tsuyuki, principal of tst ink, recruited partners architect Nancy Keenan, president and CEO of DAHLIN Group, and consumer strategist Belinda Sward of Strategic Solutions Alliance. The expert team developed and managed the America at Home Study, designed to clearly envision how the pandemic is changing consumer lifestyle preferences, and what this means for home and community design.

“When thinking about the effects of COVID on how people think about home and community, we sought answers to two key questions: Who will live here? How do they want to live?” explained Slavik-Tsuyuki.

What Does Home Mean to You in the Time of COVID?

The America at Home Study queried respondents, “Given our recent experiences of staying home because of COVID-19, what does ‘home’ mean to you?” The top answers: a safe place (91%), a place of comfort (85%), a place for family (84%).

To gather feedback about home and community directly from American consumers, the team conducted online surveys in two waves, six months apart in Spring and Fall 2020.

Slavik-Tsuyuki, Keenan, and Sward managed the first online survey April 23-30, 2020, hosted by New York-based Gazelle Global Research. They engaged a nationally representative survey of 3,001 US adults, aged 25-74 years, with household incomes of $50,000+ per year.

Wave 2, in October 2020, sought to determine if consumer preferences had changed in the six months since the initial study. Expanded questions sought to learn more about areas in health, wellness and home shopping behaviors. Conducted online in three phases, the fall edition was a similarly nationally representative survey of 3,935 US adults between the ages of 25-74, with household income of $50,000 per year or more.

Kantar, an international leader in data insights and consulting, approached Slavik-Tsuyuki, Keenan, and Sward about partnering on wave 2 of the America at Home Study. In October, Kantar integrated its MindBase® consumer attitudinal segmentation to learn about post-pandemic home and lifestyle preferences.

Notably, the study findings predict a potential housing demand of approximately 7.6 million households switching from renters to owners.

How Have Household Preferences Changed?

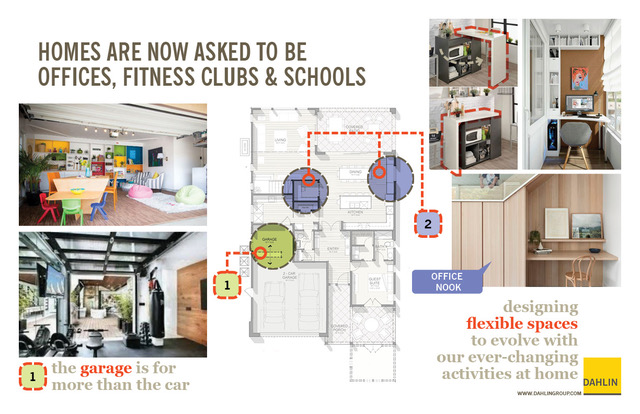

The America at Home Study found that Millennial and Gen X consumers are motivated to buy a different home based on three considerations: health and wellness, technology and energy efficiency, and specific space needs. Space needs are particularly reflected in changes in garage uses, with adaptations such as adding a home gym or exercise area, additional storage space, or a home office space.

Other findings from the America at Home Study:

- COVID-19 has shifted the motivation to buy a home, creating new demand for homeownership.

- 74% want to live in a single-family home (up from 72% in the spring)

- 50% of renters now want to own versus rent (up from 46% in April)

- Consumers are very alert to hygiene and cleanliness. More than 50% of homebuyers want:

- Germ-resistant countertops

- Greater technology/efficiency

- More storage for food and water

- Touch-free faucets, appliances, and smart toilets

- Better equipped kitchens for cooking

- More than 30% of homebuyers reported wanting:

- Touchless entry to home

- Home office for more than one person

- Adaptability of space with flexible walls

- Those surveyed were more interested in access to open space, large park, green space, and spaces to gather outside.

Respondents also indicated a willing to accept tradeoffs to be able to buy a home. “More than 50 percent indicated they would be willing to give up a private yard space as long as they had access to open space. The acceptance of smaller private space is an inspiration for future home design,” according to Slavik-Tsuyuki.

Innovation in Action: A Concept Home Based on the America at Home Study

How will home builders introduce features that reflect the noteworthy consumer preferences revealed in the America at Home Study? In a remarkably rapid transition from survey and analysis to implementation, a partnership with regional home builder Garman Homes will produce a concept home, expected to break ground in January 2021 as part of the master-planned Chatham Park in Chapel Hill, NC. Completion is expected for early summer 2021.

“Each area of the home will be based on the insights of the survey,” explained Slavik-Tsuyuki.

Prospective homebuyers will also be able to view the home virtually and online, thanks to customer experience company Cecilian Partners. A three-dimensional community map will help virtual shoppers see where a home site is in the community.

The America at Home Study has become a guiding force to anticipate rapidly changing preferences for both homeowners and renters– even if the crystal ball is actually in the shape of a high-definition screen.

Deborah Myerson is Owner/Principal of Myerson Consulting in Bloomington, Indiana.

Cover image: Crystal Ball, photo by Jamie Street on Unsplash