Home buyers really like a wide range of green features, but have limits on how far they’ll go to pay for them, according to the 2019 edition of NAHB’s publication “What Home Buyers Really Want”.

The publication is based on a 2018 survey of recent and prospective home buyers using the consumer panels maintained by Home Innovation Research Labs. The survey collected a total of 3,996 responses from consumers who either purchased a home in the last three years or who expected to purchase one in the next three years.

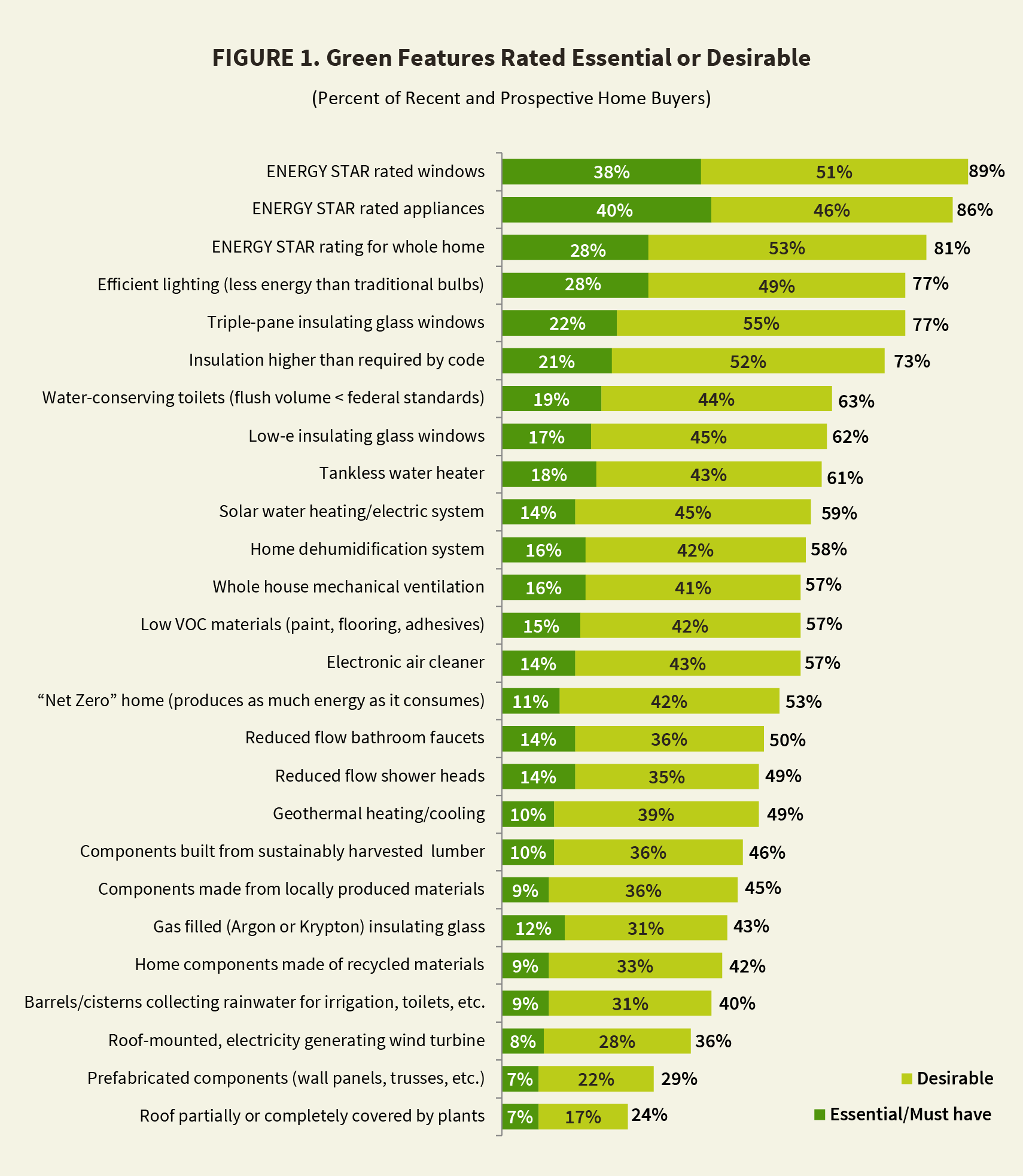

As discussed in last issue’s article, these buyers ranked three types of ENERGY STAR ratings in the top 10 of the features they most wanted (from among the 175 listed in the survey). But 50 percent or more of the buyers considered many other green features desirable or better when ranking them on the following four-tier scale.

Essential

Unlikely to buy a home without feature

Desirable

Seriously influenced to buy home if included

Indifferent

Would not influence purchase decision

Do Not Want

Not likely to buy a home with feature

Figure 1 shows the 10 “most wanted” features, based on the percentage of buyers who rate them as either desirable or essential, including the two that tied for 10th place. Ranking at the very top, according to this metric, is a laundry room, with 91 percent of buyers rating it either essential (unlikely to buy a home without it) or desirable (would be seriously influenced to buy home if included).

After the ENERGY STAR ratings, the next three most-wanted green features are also energy conserving: efficient lighting and triple-pane windows (each rated essential or desirable by 77 percent of buyers) and insulation higher than required by code (73 percent). Next comes a closely clustered group of eight green features, each wanted by 57 to 63 percent of buyers. Five of the eight are green in terms of something other than pure energy efficiency: water-conserving toilets, home dehumidification system, whole house mechanical ventilation, low- VOC materials, and an electronic air cleaner (Figure 1).

At the other end of the scale, a roof partially or totally covered by plants is rated essential or desirable by only 24 percent; it also stands out as the green feature buyers most often explicitly reject. Half of the buyers said they are unlikely to purchase a home if it comes with a plant-covered roof.

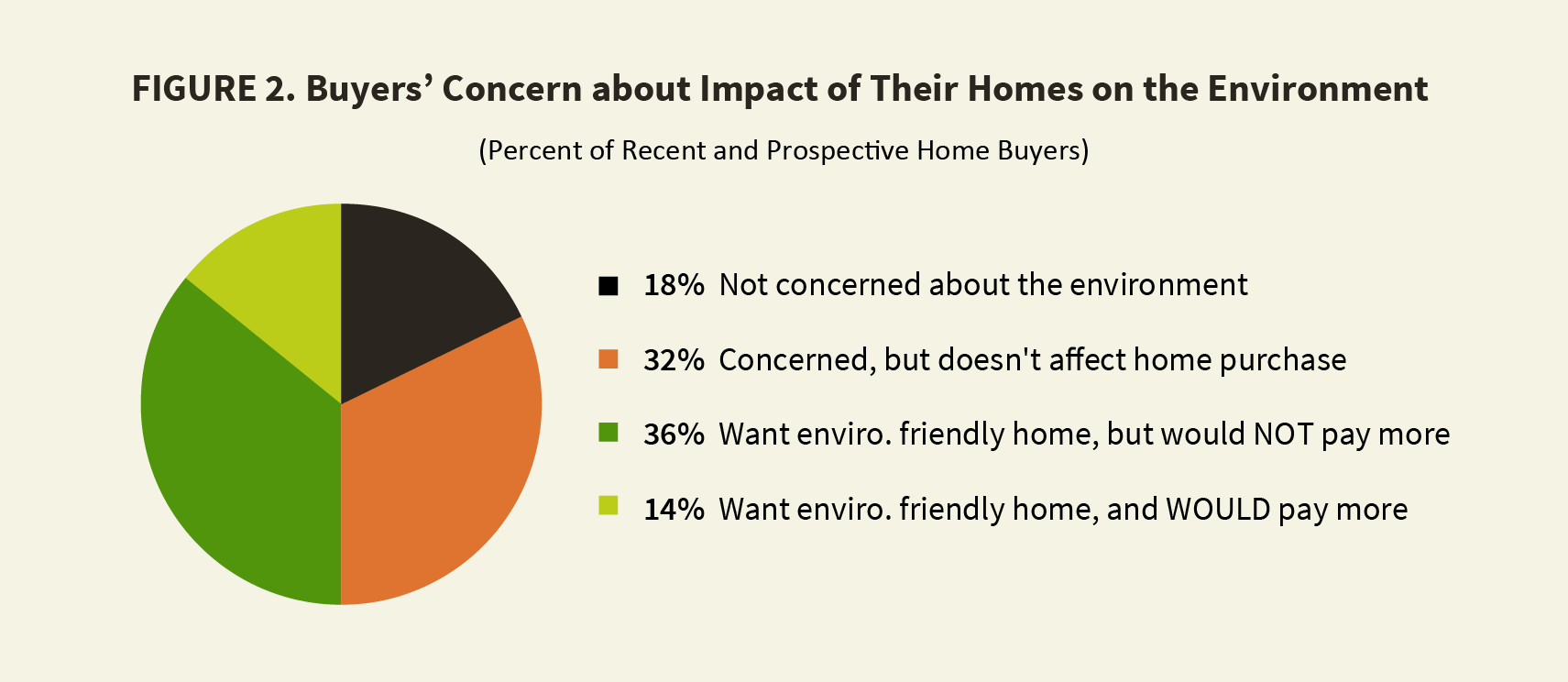

Although most buyers give a favorable rating to a large number of green features, relatively few are willing to pay more for a home simply because it is green. Thirty-six percent want an environmentally friendly home, but would not pay more for it; 32 percent say they are concerned about the environment, but simply don’t consider this when buying a home. On either side are relatively narrow slices of 18 percent who are not concerned about the environment at all and 14 percent who are not only concerned but would pay more for a house to reduce its environmental impact (Figure 2).

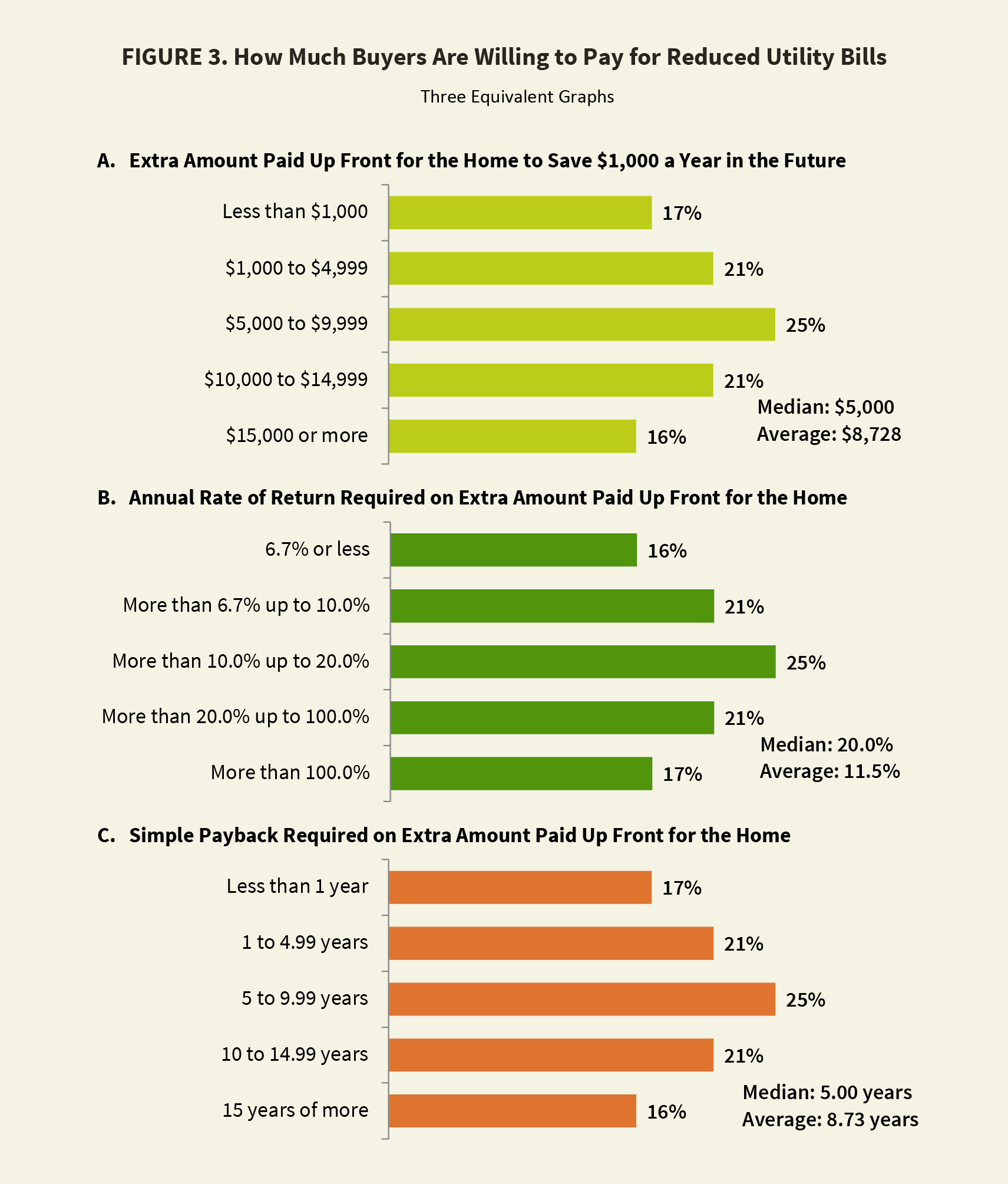

Buyers will pay more for green features that economize on their utility bills, however. When asked how much extra they’d pay up front to save $1,000 every year in utility costs, 38 percent of home buyers would pay less than $5,000 extra; 25 percent would pay between $5,000 and $9,999, and 37 percent would pay $10,000 or more (Figure 3-A).

An equivalent way to say this is to flip the question around and describe it as the rate of return a buyer requires on the up-front investment. Analyzed this way, 37 percent of home buyers require less than a 10 percent rate of return to invest up front in energy efficiency, 25 percent require somewhere between 10 and 20 percent, and 38 percent require more than 20 percent (Figure 3-B).

A third description is a simple payback period (initial cost divided by annual return) the buyer requires. This is simply the price buyers would be willing to pay up front divided by the $1,000 annual savings. By this metric, 38 percent require a payback of less than 5 years to invest in energy efficiency, 25 percent require a payback between 5 and 10 years, and 37 percent will accept a payback of more than 10 years (Figure 3-C).

The average amount home buyers are willing to pay up front to save $1,000 a year in utility cost is $8,728 (equivalent to requiring an 11.5 percent annual rate of return, or 8.73-year simple payback). The median (meaning half would pay more, half would pay less) is $5,000 (20 percent return, 5-year payback). The average is driven by a handful of buyers at the upper extreme, willing to pay quite a lot (more than $50,000) up front. It’s possible to argue that the median of $5,000, which is not sensitive to extreme responses, better represents the opinions of the typical home buyer.

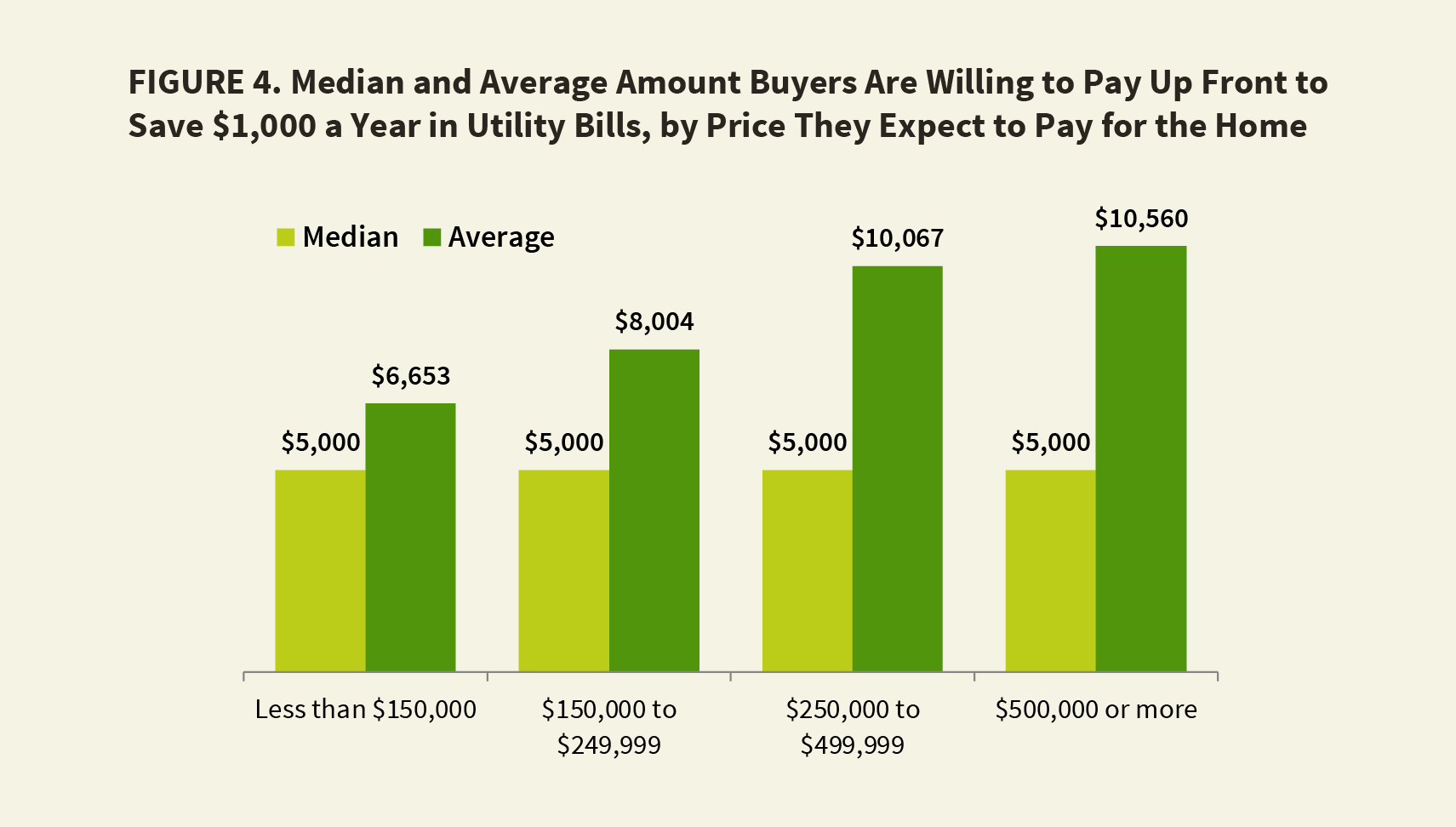

The average, but not the median, is sensitive to the price buyers are paying for the home (Figure 4). Buyers of homes priced under $150,000 will pay an average of $6,653 to save $1,000 a year in energy costs (equivalent to 15.0 percent rate of return or 6.65-year simple payback), while buyers of homes priced $500,000 or above will pay $10,560 (9.5 percent return, 10.56- year payback).

This agrees with the conventional wisdom that buyers at the modest end of the housing market are more concerned with day-to-day existence and therefore require a greater future payoff to make them part with their hard-earned cash today.