Home builders spend significant amounts of time, effort, and money to find out how to make their homes appealing to prospective buyers. Do they want gourmet kitchens or a spa-like master bath? Great rooms with soaring ceilings or lots of flex space?

According to NAHB’s 2019 edition of “What Home Buyers Really Want,” their needs and wants are much more down-to-earth, starting with a laundry room. After that, three of the next 10 most-wanted features are ENERGY STAR ratings for windows, appliances, and a whole-house rating.

At the other extreme, an elevator is the feature that would turn potential buyers away more than any other.

Using consumer panels maintained by the Home Innovation Research Labs, the survey collected responses in spring 2018 from 3,996 recent home buyers (those who purchased a home in the last three years) and prospective buyers (those expecting to buy a home in the next three years).

A substantial section of the survey asked recent and prospective buyers to rate 175 home and community features using the following four-tier scale, which emphasizes how a feature influences the buyer’s purchase decision:

Essential

unlikely to buy a home without feature

Desirable

seriously influenced to buy home if included

Indifferent

would not influence purchase decision

Do Not Want

not likely to buy a home with feature

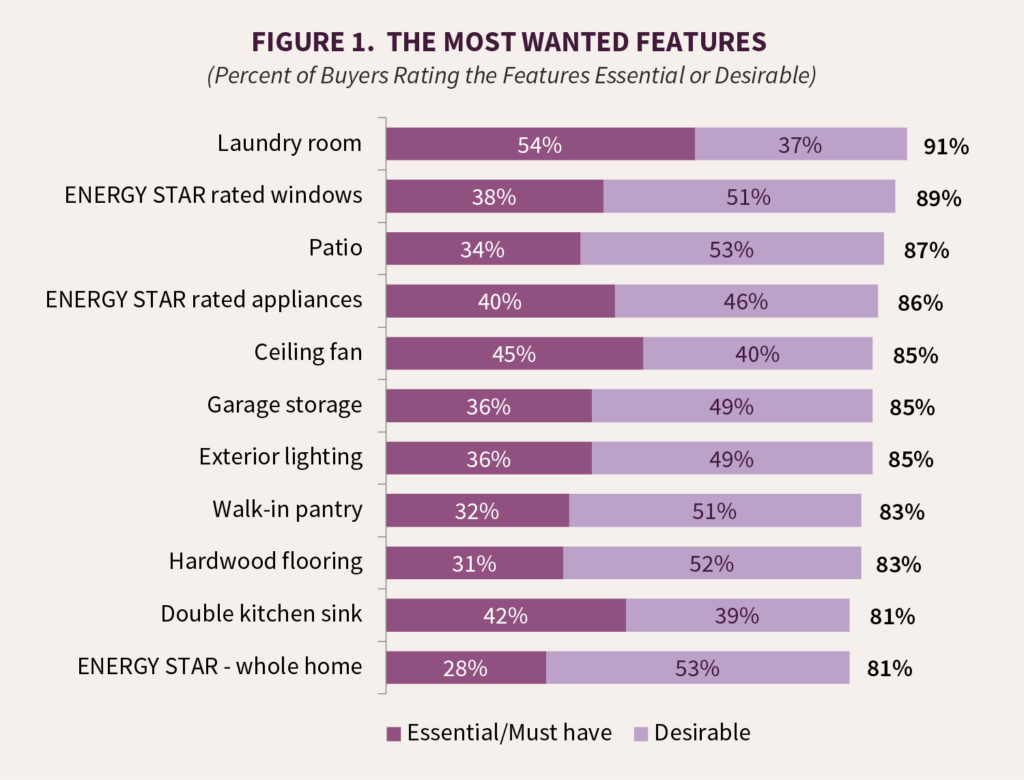

Figure 1 shows the 10 “most wanted” features, based on the percentage of buyers who rate them as either desirable or essential, including the two that tied for 10th place. Ranking at the very top, according to this metric, is a laundry room, with 91 percent of buyers rating it either essential (unlikely to buy a home without it) or desirable (would be seriously influenced to buy home if included).

All three of the survey’s categories of ENERGY STAR ratings also appear on the most-wanted list. The essential/desirable shares for these ratings are 89 percent for windows, 86 percent for appliances, and 81 percent for an ENERGY STAR rating covering the entire home. Two outdoor features ranked among the most wanted: a patio (rated essential or desirable by 87 percent of buyers) and exterior lighting (by 85 percent). Two other most-wanted features highlight the importance of home organization: garage storage (rated essential or desirable by 85 percent of buyers) and a walk-in pantry (by 83 percent). The other most-wanted items were a ceiling fan (with an essential/desirable share of 85 percent), hardwood flooring for the living spaces on the main floor (83 percent), and a double sink in the kitchen (81 percent).

A treasure trove of data

NAHB has conducted home buyer preference surveys since 2003. Most of the essential/desirable percentages for the items in Figure 1 have remained relatively stable over that span. In the last two iterations of the survey (2015 and 2018), the largest upward changes were a 4-point increase in the desirable/essential share for garage storage and a 3-point increase for patios.

For garage storage, this simply reversed a 2015 downturn and took the essential/desirable share back close to where it had been in 2012. For patios, however, the latest increase represents part of a longer trend. The share of buyers rating a patio as essential or desirable has increased with every preference survey since 2003, when it stood at 73 percent.

Thumbs down

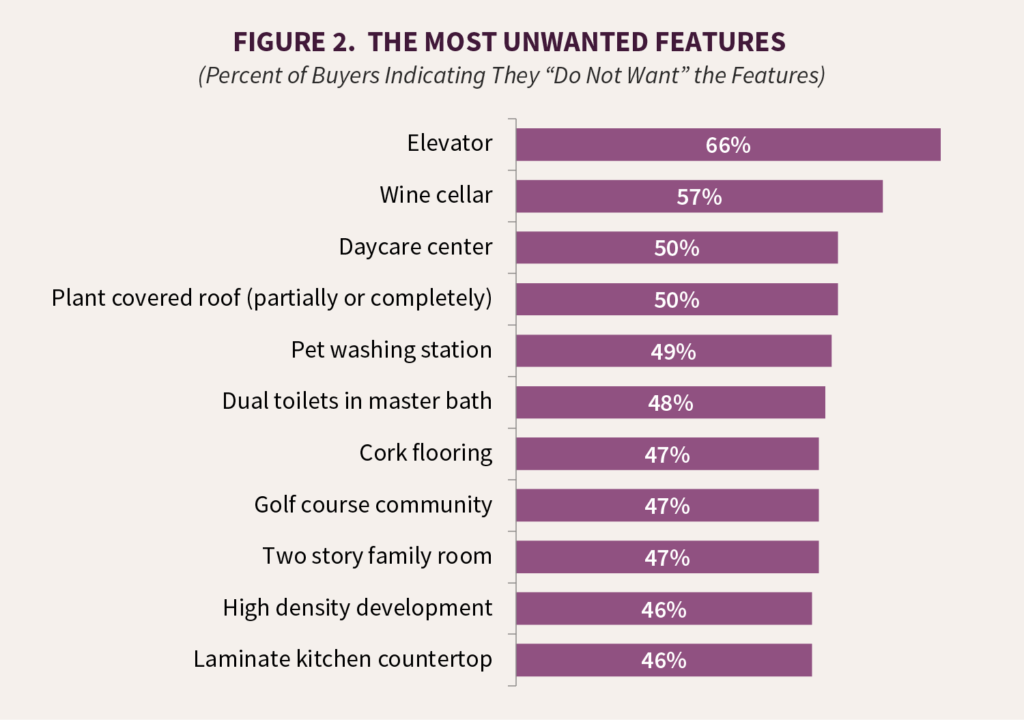

In addition to features home buyers want, builders should also want to identify the features that a large proportion of their buyers do not want. Figure 2 shows the 10 most-unwanted features (including ties for 10th place) based on the share of buyers rating the item “do not want.” Again, a “do not want” rating means buyers are unlikely to purchase a home if it has that particular feature.

By this criterion, an elevator ranks as the most-unwanted feature, explicitly rejected by two-thirds of all home buyers. It’s important to remember, however, that a niche market usually exists even for an item as generally unpopular as an elevator. Despite the large share of buyers who do not want one, 12 percent of buyers think an elevator is desirable, and 6 percent consider it essential. Moreover, an elevator may be necessary under some circumstances. For example, local regulations, land costs, or other factors could make multi-story townhomes a builder’s only viable option.

At least half of all buyers also are unlikely to buy a home if it comes with a wine cellar (57 percent) or a plant-covered roof, or is in a community with a daycare center (each 50 percent). In addition to the daycare center, two other items on the most unwanted list are features of the community in which the home is located, rather than of the home itself. Forty-seven percent of buyers do not want to live in a community with a golf course; 46 percent do not want a home in a high-density community with smaller lots and attached or multifamily buildings.

Laminate countertops are out

Many of the items in Figure 2 did not appear on earlier versions of NAHB’s home buyer preference survey. Some also appeared in a different format, so the results are not directly comparable to the 2018 survey. Nevertheless, several of the items do have a consistent history back to 2003. One notable trend over that time is that buyer resistance to homes in golf course communities has become considerably less widespread. The “do not want” share for golf course communities declined from 73 percent in 2003 to 47 percent in 2018.

On the other hand, buyers have become more resistant to laminate kitchen countertops over time, with a “do not want” share of 26 percent in 2003 vs. 46 percent in 2018. This result is probably not surprising, given the way manufacturers have continued to develop and improve countertop materials over that span.

Many additional results—including detailed tables that break down the answer to every question by geography (Census divisions), buyer type (first-time vs. repeat buyer), age , generation, household composition, race/ethnicity, income, and price expected to pay for the home—are available in the full, 300-page report.