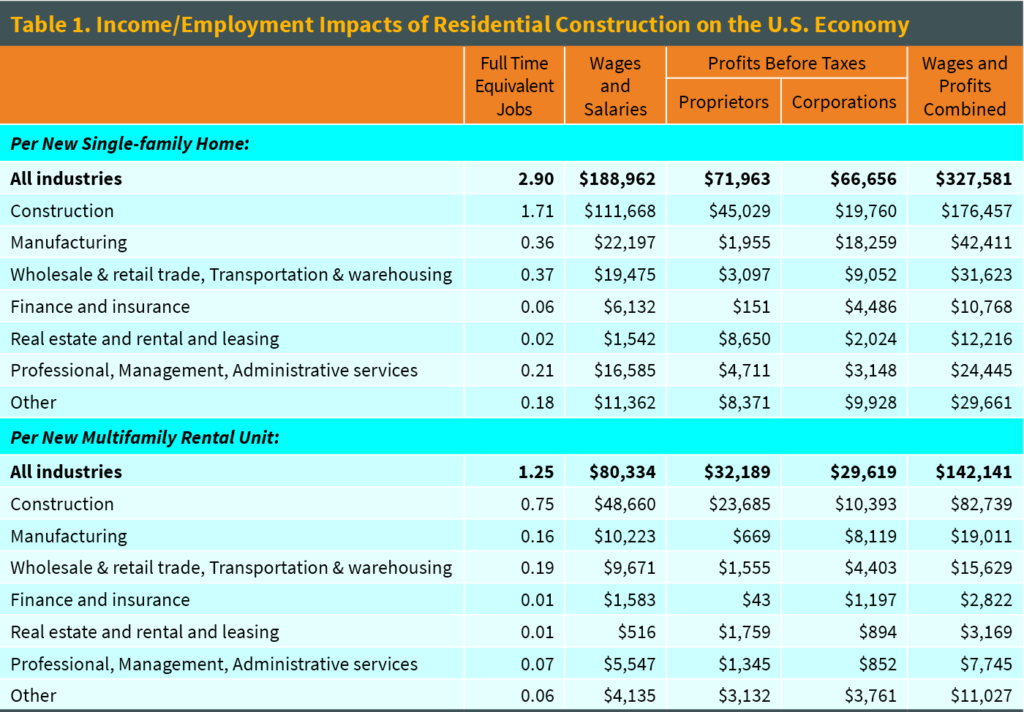

A recent NAHB article illustrates the role home building can play in leading a recovery, once the economy opens up following the coronavirus-induced downturn. In particular, the article updated NAHB’s estimates of the number of jobs generated, nationally and by industry, when a new home is built. The new estimates show that building an average single-family home generates 2.90 jobs, measured in full-time equivalents (enough work to keep one worker employed for a year); building an average rental apartment generates 1.25 jobs.

Keep in mind that these are national estimates, designed for use when the impacts on all U.S. suppliers of goods and services to the construction industry — for example, manufacturers of building products — are of interest. Never try to use these national estimates to analyze impacts of home building on a state or local economy. NAHB maintains separate local impact estimates for that.

Jobs by Industry

Probably the most obvious impacts of new construction are the jobs generated for construction workers. But additional jobs are generated upstream in the industries that produce lumber, concrete, and the many other products that go into a home. Construction also generates jobs for those who transport, store, and sell building products; and jobs for professionals, such as architects, engineers, real estate agents, lawyers, and accountants.

NAHB uses input-output and other tables produced by the U.S. Bureau of Economic Analysis (BEA) to estimate these jobs, as shown in the following diagram:

The key input is the value of construction. The values used in NAHB’s new estimates are an average construction value of $421,000 for single-family homes and $169,000 for rental apartments. Details, including data sources, are given in the original article. The jobs, wages and salaries, and profits generated by single these construction values are summarized in Table 1.

The largest share of wages and salaries are generated in the construction industry, followed by manufacturing; trade, transportation, and warehousing; and professional, management, and administrative services.

Note that in the construction industry, profits of proprietors are roughly 40 percent as large as wages and salaries. Many of these proprietors are subcontractors, often quite small, even one-person operations. These numerous, but relatively small businesses are excluded from the jobs reported in Table 1, because the government doesn’t classify the self-employed as having jobs, even though most casual observers would probably think of them that way.

Impact on Taxes

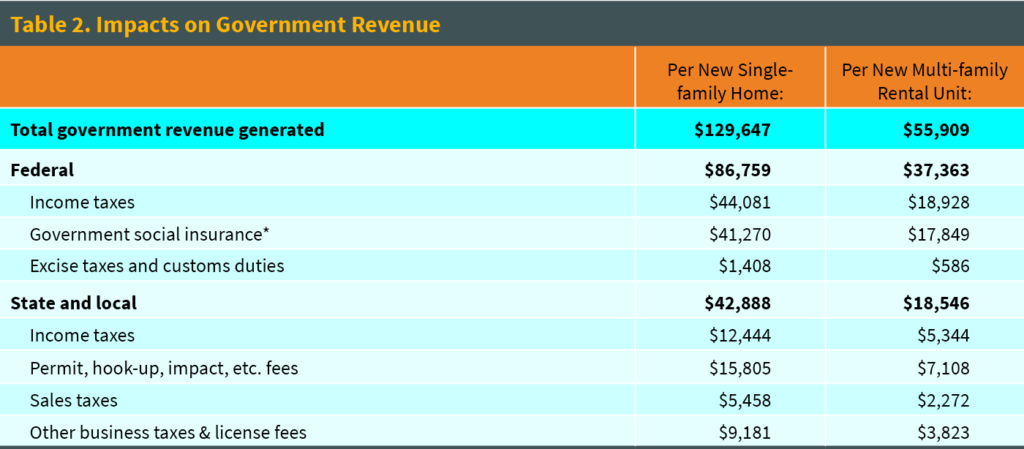

The wages, salaries, and profits in Table 1 are subject to a variety of federal, state, and sometimes local taxes and fees. NAHB also estimates this tax and fee revenue, as shown in Table 2.

At the federal level, income taxes include those paid by corporations, receivers of dividends from corporations, proprietors, and employees. Corporate income taxes paid and dividends are available by industry from the same series of BEA income and employment by industry tables shown in the flow chart. Otherwise, federal income tax rates of 15 percent are applied to dividends, and 24.46 percent to proprietor’s income (which incorporates a downward adjustment because the self-employed component of social security taxes is deductible). Variable income tax rates are applied to wages and salaries, depending on the industry in which they’re earned, that averages to 8.906 percent.

Government social insurance paid by employers (which includes social security, Medicare, and unemployment insurance) is also available directly from the income and employment by industry tables. Rates of 7.65 percent and 15.30 percent are applied to wages and salaries and proprietors’ profits, respectively.

BEA industry tables include a category called taxes on production and imports. Most of this is sales taxes collected by state (and sometimes local) governments, but a relatively small share consists of excise taxes and customs duties collected by the federal government.

NAHB uses BEA government receipt tables to separate the federal items from sales taxes, and to estimate state and local income tax revenue as a ratio equal to 28.2 percent of the federal income taxes.

Residential property taxes are not included in Table 2, because Table 2 shows one-time revenue impacts realized roughly in the same year construction takes place. According to the Census Bureau’s 2018 American Community Survey data, the average effective property tax rate on owner-occupied homes is 1.1 percent of the property’s value.

Finally, permit, hook-up, and impact fees are estimated as 3.54 percent of a for-sale single-family house price, taken from NAHB estimates described in its Special Study on Government Regulation in the Price of a New Home.

The bottom line is that building an average single-family home generates $129,647 in taxes and other revenue for federal, state, and local governments combined; and building an average rental apartment generates $55,909.

Conclusion

The national economic impacts of home building include a substantial number of jobs for employees working directly on the construction project, as well as jobs generated indirectly in firms that manufacture building products, transport and sell the products, and provide professional services (e.g., architects and real estate agents). In the process, the construction generates profits to help sustain entrepreneurs and taxes to help support government budgets.

In summary, home building generates jobs in industries such as construction and manufacturing, jobs for highly educated professionals including engineers and financiers, and revenue to support owners of small businesses, such as construction trade contractors. This is an attractive mix of activities to support in a healthy economy, especially an economy going through a period of recovery.