In 2015, NAHB produced its 800th customized local impact home building study. Like the first 799 studies, the 800th estimated the income, jobs, and taxes generated by home building activity in a particular metropolitan area, non-metropolitan county, or state.

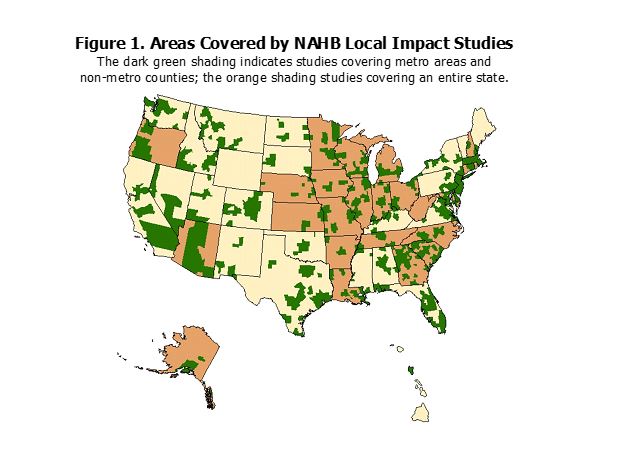

Figure 1 shows parts of the country covered by the studies. The darkest shading indicates studies covering metro areas or non-metro counties; the somewhat lighter shading indicates studies produced for an entire state.

The local market area analyzed by NAHB must be large enough to include places where construction workers live, and places where the new home occupants work and shop (typically a metropolitan area or non-metropolitan county), but the construction can be confined to an individual jurisdiction or development. Since 1996, the studies have been used to help get individual projects approved, counter anti-growth proposals, and generate publicity for the local home building industry.

A customized report can be ordered by anyone willing to pay the fee and provide the inputs needed to run the NAHB model. For those lacking the time or resources, NAHB produces a general report for a typical or average local area that is available free to all online.

NAHB has recently updated this “typical local” report. It shows the jobs, income, and taxes generated by building 100 single-family homes and 100 rental apartments, as well as $1 million of residential remodeling in a typical local area.

The new estimated one-year impacts of building 100 single-family homes are in a typical local area are:

- $28.7 million in local income,

- $3.6 million in taxes and other revenue for local governments, and

- 394 local jobs.

And the annual, ongoing impacts (resulting from the home becoming occupied and the occupants paying taxes and otherwise participating in the local economy year after year) are:

- $4.1 million in local income,

- $1.0 million in taxes and other revenue for local governments, and

- 69 local jobs.

Similarly, the estimated one-year impacts of building 100 rental apartments are:

- $11.7 million in local income,

- $2.2 million in taxes and other revenue for local governments, and

- 161 local jobs.

For apartments, the annual ongoing impacts are:

- $2.6 million in local income,

- $503,000 in taxes and other revenue for local governments, and

- 44 local jobs.

Finally, the one-year impacts of spending $1 million on residential remodeling in the typical local area are estimated at:

- $841,000 in local income,

- $71,000 in taxes and other revenue for local governments, and

- 11 and a half local jobs.

NAHB’s default assumption is that remodeled homes are occupied before and after remodeling, so the annual local impacts are limited to:

- $11,000 in residential property taxes.

Jobs are measured in full-time equivalents—i.e., enough work to keep one worker employed full-time for a year.

The above estimates are generated from a proprietary NAHB model that captures the income earned by local industries during construction, the ensuing “ripple” effects that occur as some of this income is spent locally, and ongoing effects of increased property taxes and the new homes becoming occupied.

For a builder or developer interested in applying the local impact model to a particular construction project, possibly to help get the project approved, more information is available on the Housing’s Economic Impact page on NAHB’s Web site.